As we’ve seen in the 2025 NGCOA Annual Business Pulse report, bullish attitudes continued to greet the golf industry as we concluded a fifth consecutive year of strong operating results and increasing rates. That said, there has been an underlying cautiousness as more facility operators began to question the sustainability of the participation and revenue surge, accompanied by an increasing incidence in those who were planning to pull back slightly on the throttle amidst various questionable macroeconomic factors.

Entering the traditional golf season, uncertainty remains prevalent, as the latest data in our ongoing Consumer Optimism Barometer shows pockets of softness, still accompanied by an impetuous drive by many to live in the present and let tomorrow happen. Certainly, the financial markets’ roller coaster ride of early Spring has done nothing but solidify many of the mixed signals that we continue to receive from golfers.

On the concerning side, overall optimism has been trending downward, hitting a low point in early April, with preliminary May data suggesting a leveling off, which also signals uncertainty. Similarly, our three primary measures of inflation continue to show two-thirds of Americans perceiving consumer prices to be increasing over the most recent six-month period. Recessionary fears have increased +8 points since January, though it is worth noting that recessionary perceptions are highly correlated with one’s political leanings.

Certainly, the markets and consumers are continuing to sort through the implications of the frenetic first 100 days of the new administration. In late March, we asked Americans whether they felt that things in Washington were moving too fast, not fast enough, or at the right pace. A plurality of 45% felt that things were moving too fast, and even Republicans were just as likely to feel that way as they were to suggest that things needed to move faster.

But while much of the nation waits or hunkers down to assess the impact of potential tariffs and an economy thrown into question, there remain a number of positive signs and implications for the golf industry. While business travel intent is off twelve points from last October, leisure travel indicators remain relatively stable. Couple this with a slight rally in hybrid work, and one can infer that what we’ve labeled to be “The Great Reprioritization” remains intact and continues to suggest that golf’s greater democratization of offerings combined with a persistent desire on the part of consumers to live for today maintains an environment conducive to increasing or maintaining robust participation levels.

The NGCOA Business Pulse report and other ongoing SLRG research continues to show a public that is spending it forward. Those indicating that they had been financing their credit card payments more these days than they had a year ago was up +6 points to 30% in March of this year relative to last March. The incidence of Americans who strongly agree that if they see something they like, they don’t worry about price, has doubled from a two year low of 13% in December to more than a quarter in early April. According to the Federal Reserve Bank of New York, Americans' total credit card balances now stand at a record-high $1.21 trillion…the 10th time in the past 11 quarters in which credit card debt increased or remained the same.

/

This continues to suggest a widening rift between “the haves” and the “have nots” that should drive very hyper-local strategies for golf facilities based on the profiles and attitudes of their target consumer and the strategic actions of competing activities and diversions seeking share of discretionary time. It also spawns caution, if the cost of inputs rises higher than price elasticities will allow course owners to optimize rates.

/

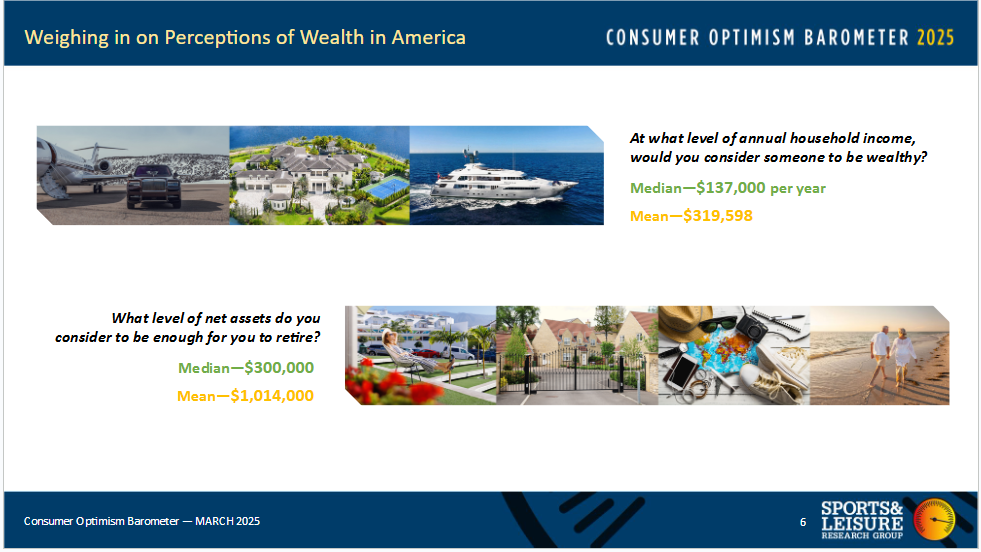

Further illustrating the above phenomenon is new data that we’ve collected on the perceptions of wealth, illustrated in this accompanying chart.

While the mean figures are inevitably skewed somewhat by right side of the bell curve outliers, the medians are telling in that when they are viewed in context with some of the other economic data noted above, and a general “wait and see” sentiment that we are observing, we may experience building demand pressure in the lower half of the market, absent stability or clarity with financial conditions. It’s something we will closely monitor as we head into the peak of the golf season.