By Harvey Silverman, Contributor, Golf Business | Silverback Golf Marketing

By Harvey Silverman, Contributor, Golf Business | Silverback Golf Marketing

My last Golf Business WEEKLY article revealed more about the sudden Google partnership with GolfNow and illustrated Google’s intent to connect to all golf courses’ online booking capabilities. I can now elaborate on how golf tee times have an opportunity to make a quantum leap in how they are found and booked.

Tuesday, July 16, marked a seminal day as several of the major Golf Management System (GMS) executives participated in an NGCOA-led conference call about Google’s plans for tee time bookings. Participating GMS companies included Club Caddie, Club Prophet, Eagle Club Systems, foreUP, Golfmanager, Lightspeed, MemberSports, Tee-On, Teesnap, and Whoosh. Also present were GolfBack and several key NGCOA personnel. Most importantly, the Google Partnerships project manager in charge of this initiative was on the call and answered several questions.

Ian Versaw of Club Prophet remarked, “The NGCOA quickly organized tee sheet providers with a coordinated effort to support and center the needs of golf operators. We appreciate the NGCOA's leadership in deepening our industry's relationship with Google and are excited to bring the benefits of enabling our customers to activate direct booking from their tee sheet within the search engine results page (SERP).”

Jay Karen, NGCOA’s CEO, voiced a distinction I and others have written about for years. Third parties like GolfNow are “disintermediates.” They engage between the consumer and the endpoint of the reservation. The travel industry is full of them, known as “OTAs,” or “Online Travel Agents,” and are prolific on Google. Google identified the GMS companies as “intermediaries,” and stated the goal of helping facilitate direct bookings on the Google platform for golf course owners and operators.

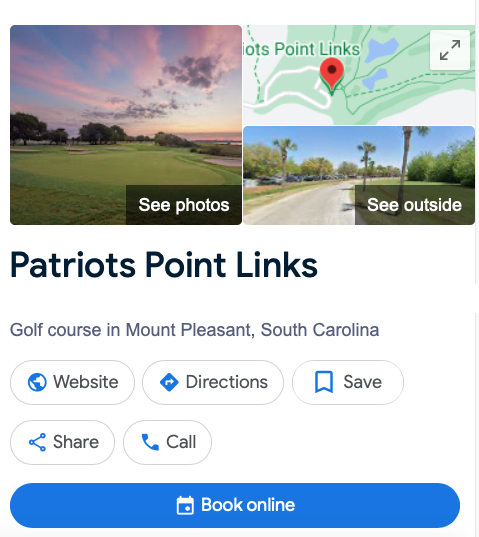

Karen displayed to the group a local course’s Google search page and the “big blue button” found on its information panel. It was noted that the “Book Online” button may appear differently on other devices, like phones and iPads.

That button takes the golfer here, to GolfNow, and not to the golf course website. This is what set off the alarms at NGCOA HQ. “Why is that?” you may ask. Because course operators had no notice about this appearing and knew of no way to stop it with GolfNow.

But now we know more. First, if they wish to do so, a GolfNow course must request from GolfNow that the button be removed, not Google. Preliminary information indicates this can happen in two to three days or several days longer. The reason the course must work through GolfNow is because it is the intermediary between the course and Google. Google conducts a thorough vetting process for each intermediary it agrees to connect with, and the intermediary is required to provide some sort of verification of its clients that wish to connect, such as name, address, geo-location, phone number, etc. GolfNow was properly vetted and approved by Google. However, Google does not control how GolfNow works with nearly 3,000 courses. They assume there is an implied permission that all clients give to GolfNow to do this on their behalf. More on this later.

Second, the GMS companies will become Google-authorized intermediaries after submitting official paperwork and passing Google’s vetting process. For courses using the various GMS systems, you’ll be able to request the booking button from your GMS. The GMS companies will verify and submit to Google the booking link URL to be inserted behind the “Book Online” button for each course that chooses to own that digital piece of real estate. All the golf course must do is let their GMS partner know, “We want this.”

And, in my opinion, that’s where GolfNow shot itself in its FootJoy. It ignored transparency and placed the booking button on every client course's Google search page without their knowledge and expressed permission. We have a couple of impressions of the language in the GolfNow contract agreement, but it would take a good attorney to determine if what GolfNow did was within their legal boundaries as spelled out in the contract. For now, we’ll let unhappy GolfNow clients figure that out.

What GolfNow did will not happen with the GMS companies that participated in the summit call. It remains to be determined whether and how the GMS companies will reach out to their clients or if they’ll sit back and wait for requests on a singular basis - or power through and simply deliver the booking URLs for their clients, like GolfNow did (but these would be direct booking links). Also, we may see a new clause in their contracts regarding third-party integrations or maybe something specific to Google. They must assure Google that they have the contractual approval to share clients’ data with third parties.

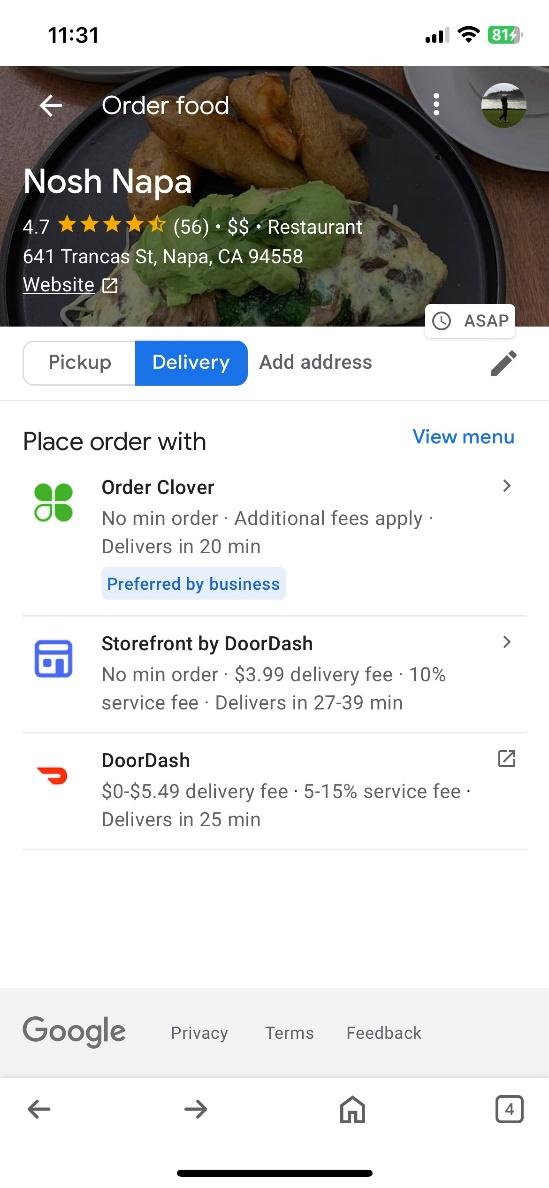

Google also informed that courses could have more than one booking choice linked behind the “Book Online” button. But why would courses want this? Some GolfNow courses share in the transaction fee or Hot Deal proceeds, so you can understand why GolfNow would like courses to be slow in getting direct booking links up on Google. Multiple links might look like what some restaurants offer for take-out delivery, like seen here. It gives customers choices based on preference, fees, timing, etc. However, the owner is in full control to have or suppress the links most important to its business.

Several concerns were raised in the call. First, what happens when a golf course changes GMS systems? Who is responsible for removing the old, non-functioning link? According to Google, it’s the old system’s responsibility to inform Google of the change, and the new system, assuming it has the Google integration, will communicate the new link with it. Will a Google integration become an important point to ask when shopping for a new system? We’ll wait to see.

Another concern raised recognizes that the GMS companies will have to devote resources to first connecting with Google and then communicating the possibilities with their clients. Should they be compensated for incurring the potential costs? In my opinion, a nominal fee is justified, possibly added to the monthly or annual software fees. If one GMS makes this move, the market will determine its acceptance or rejection for the others. Google offered that in other verticals, it may be “table stakes” for a software company to do this for their clients, rather than charge a separate fee.

Opening Google Search to online tee time bookings reveals another curious aspect of the golf industry’s slow adoption of technology. According to a recent count, between 3,000 and 4,000 public golf courses did not have online booking capabilities. They show up in search efforts, but as golfers see more opportunities to easily book from a Google Search page, they’ll be left out. Southwest Airlines finally relented to have reservation capabilities on Google Flights (and others), understanding the power and consumer use of online search. For course operators who decline to join the digital age, all of this may be a bit of a “nothing burger.” For those who have been on the fence, this new reality might make it time to climb down and join the party.

We expect there to be a second phase as Google studies and models the “customer journey” to booking a tee time and its intricacies. It’s excited about golf’s interest, another derivative of the COVID-fueled interest in the activity. The “journey” must include pathways for choices during an online search for tee times, like nine holes or 18? Is it walking or with a cart or caddie? Morning, afternoon, or evening? And more.

Public golf courses are now facing an intelligence test. Google has a massive reach and now opens its search window to allow the booking of online tee times. Courses can choose where that booking link goes—directly to their website booking page or to a third-party disintermediary where searchers can easily see and find other places to play, disrupting the loyalty good operators try so hard to obtain and maintain.

Jonathan Wride, CEO of Tenfore Golf, said, “I asked a friend to connect us to the person managing this initiative with Google, and a call was quickly set up. The response from Google was very positive. In just ten days of learning about the issue, GMS leadership has been mobilized to meet and work with Google. This is what trade associations like NGCOA do best – organize and educate industry stakeholders for the benefit of everyone.”

Who will make the smart choice, and who won’t? We’ll know soon enough. In the meantime, I’ll use a famous quote regarding the passage of a major piece of legislation: “This is a big f&*%ing deal.”