By Jon Last, President, Sports & Leisure Research Group

As seen on NGCOA's Research Center dashboard

Business cycles are a never ending tug of war between opposing economic conditions. As we make our way through the peak of the 2022 golf season, we see the conflicting forces of unprecedented inflation levels smacking right up against the two year upswing in player participation and a resultant push for more topline revenue. Our recently released 2022 Golf Business Pulse Report published by NGCOA, and sponsored by USGA, provides some valuable perspective from golf facility owners on where things are headed in the short to mid term.

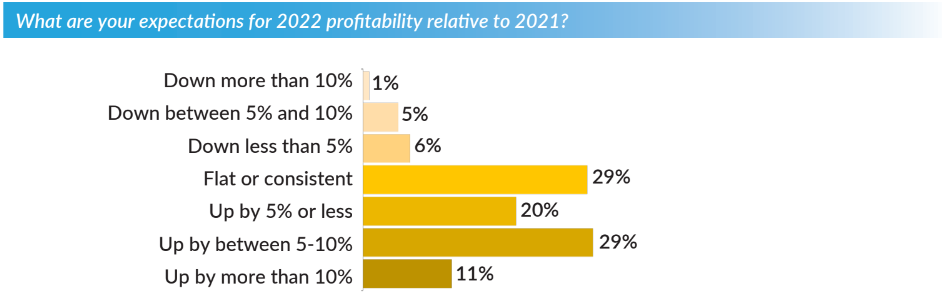

On the positive side we saw 58% of golf facility owners strongly agree that the business was booming, with 40% anticipating +5% or greater profitability growth for the current season.

In depth interviews conducted with a broad representation of course owners, illustrated this sentiment with a continued influx of newer players and those who increased their frequency of play during the COVID pandemic. Such optimism is supported by our ongoing Back to Normal Barometer data that continues to affirm that a majority of active Americans have been underwhelmed by their return to favorite pre-pandemic activities like dining out, travel or going to the movies. In our late July Barometer data, some 56% of Americans agree with this sentiment, the highest we’ve seen since last October. These leisure industries continue to struggle with under-staffing and returning to normal operations after pandemic driven shutdowns.

In depth interviews conducted with a broad representation of course owners, illustrated this sentiment with a continued influx of newer players and those who increased their frequency of play during the COVID pandemic. Such optimism is supported by our ongoing Back to Normal Barometer data that continues to affirm that a majority of active Americans have been underwhelmed by their return to favorite pre-pandemic activities like dining out, travel or going to the movies. In our late July Barometer data, some 56% of Americans agree with this sentiment, the highest we’ve seen since last October. These leisure industries continue to struggle with under-staffing and returning to normal operations after pandemic driven shutdowns.

The labor crunch, while certainly a major issue for golf facilities as well, has been particularly vexing in the leisure sector overall. In research conducted just two months ago, for the U.S. Chamber of Commerce, we continue to find that those who left jobs in the leisure sector during the pandemic, and have not yet returned to the labor force, are the most likely to seek their next employment in a different industry. This trend has been evident since we first measured it over a year ago.

Bottom line, while the majority of Americans have resumed their pre-pandemic activities, the shift in how they have allocated their available leisure time has yet to revert to their old habits. We also see the trend towards hybrid or work from home stabilizing, thus continuing to reallocate the ways in which consumers balance their time. Yes, time, that great unmovable inhibitor to golf participation, continues to show movement in a favorable direction for our industry.

Bottom line, while the majority of Americans have resumed their pre-pandemic activities, the shift in how they have allocated their available leisure time has yet to revert to their old habits. We also see the trend towards hybrid or work from home stabilizing, thus continuing to reallocate the ways in which consumers balance their time. Yes, time, that great unmovable inhibitor to golf participation, continues to show movement in a favorable direction for our industry.

These factors remain as positive indicators for the golf industry and facility operators have reacted accordingly by pursuing rate increases. As you can see below, the overwhelming majority of facility owners have done so in 2022.

However, where the storm clouds are emerging is in the persistent bane to spending that inflation and fears of an impending recession have permeated the national economic conversation. We all saw the June CPI numbers, and the inversion of the yield curve and those conditions have not been lost on the American Consumer. In our late July Back to Normal Barometer, 57% believe that we are already in recession. That is up a significant +7 points from June and the highest incidence of agreement that we have since the inception of the study back in March of 2019. In an additional trending measure, we continue to see upwards of three quarters of Americans that report prices of consumer goods to be somewhat or considerably higher than they were pre-pandemic, and perceived pricing for travel related services remain on a steep upward trajectory, after significantly lagging consumer goods earlier this year.

However, where the storm clouds are emerging is in the persistent bane to spending that inflation and fears of an impending recession have permeated the national economic conversation. We all saw the June CPI numbers, and the inversion of the yield curve and those conditions have not been lost on the American Consumer. In our late July Back to Normal Barometer, 57% believe that we are already in recession. That is up a significant +7 points from June and the highest incidence of agreement that we have since the inception of the study back in March of 2019. In an additional trending measure, we continue to see upwards of three quarters of Americans that report prices of consumer goods to be somewhat or considerably higher than they were pre-pandemic, and perceived pricing for travel related services remain on a steep upward trajectory, after significantly lagging consumer goods earlier this year.

This leaves golf operations in the aforementioned crosswinds, raising the frequently asked question of how things will ultimately net out both in terms of the participation surge and the ability to sustain rate increases. In NGCOA’s 2022 Golf Business Pulse Report, we see a meaningful number of facility owners questioning this, and nearly a third expressing concern about facility operator complacency.

In our depth interviews for the 2022 Golf Business Pulse Report, a number of industry leaders expressed concerns that many might repeat the mistakes of the previous participation surge and price themselves out of the market. In fact in our survey work for the study, a majority expressed similar concerns.

In our depth interviews for the 2022 Golf Business Pulse Report, a number of industry leaders expressed concerns that many might repeat the mistakes of the previous participation surge and price themselves out of the market. In fact in our survey work for the study, a majority expressed similar concerns.

I recently addressed a group of multi-facility course owners in Canada about these phenomena, and a logical question that surfaced was how should a facility net out in determining optimal pricing amidst these conflicting forces and continued cost pressures on facility bottom lines. Unfortunately, as I responded, there is not a generic answer that applies to all facilities. As I’ve often commented, and share within the Golf Business Pulse Report, the deployment of effective yield management systems is one strategy. Another is to conduct price elasticity research among customers and potential customers. The latter is something that we’ve frequently deployed across golf and other leisure industries to better grasp the primacy that a customer places on a particular product or service. We’ve often been pleasantly surprised to find that particularly among best customers (high recency, frequency and prior spending) there’s a willingness to continue to support price increases, even amidst challenging economic conditions. However, the circumstances are situation specific and predicated by not only the macro economy, but the strategic actions of competitive substitutes.